Table of Contents

- Overview

- What are South Africa’s IFWG and CAR WG?

- How South Africa’s crypto asset regulations align with FATF

- South Africa’s “Travel Rule” for CASPs

- What is a South African crypto asset service provider (CASP)?

- Why does the RSA need a clear crypto asset regulatory framework?

- CAR WG’s 30+ crypto regulation recommendations

- What’s next for South African crypto asset regulation?

Overview of IFWG/CAR WG policy paper

South Africa’s financial authorities released a lengthy Position Paper on Crypto Assets on 14 April 2020. The policy paper aims to create a strong regulatory framework for crypto assets in accordance with the Financial Action Task Force’s anti-money laundering and counter-terrorism funding (AML/CFT) regulations.

This comes after a 2019 study showed that over 10% of South African internet users own cryptocurrencies like Bitcoin- the highest per capita in the world.

The country’s Intergovernmental Fintech Working Group (IFWG) created the 58-page position paper in a joint initiative with its Crypto Assets Regulatory Working Group (CAR WG).

The document features over 30 crypto asset recommendations, ties together work done by CAR WG since 2018, and builds on its 2019 consultation paper on crypto assets.

Some of the key recommendations are:

- Crypto assets in South Africa should “remain without legal tender status” and not be viewed as electronic money or currency.

- Most companies offering crypto services are now considered “Crypto asset service providers (CASPs)” and must comply with FATF’s AML/CFT measures like the Recommendation 16 travel rule.

- South Africa should adopt a unified regulatory framework that is risk-based (RBA), phased, technology-neutral, based on principles, adaptive and resilient.

- Authorities should take a “clear stance” against the current lack of South African crypto asset regulations to mitigate the threat that cryptocurrencies pose to the financial system.

- The paper defines both crypto assets and types of CASPs that will be obligated to register with the Financial Intelligence Center (FIC) as regulated “accountable institutions” (similar to the AMLD5’s “obliged entities”) under its Financial Intelligence Centre Act (Schedule 1).

The policy paper is now open for comments from the public and stakeholders until 15 May 2020, after which it may be amended and sent to the Minister of Finance for final approval before it makes its way before Parliament.

South Africa’s Regulatory Working Groups

What is the Intergovernmental Fintech Working Group (IFWG)?

South Africa’s Intergovernmental Fintech Working Group (IFWG) was formed in 2016 to help regulators and lawmakers take a risk-based approach to fintech developments and gain a “common understanding” of possible implications on its financial industry and economy.

IFWG members include teams from the South African Reserve Bank (SARB), National Treasury (NT), Financial Intelligence Centre (FIC), Financial Sector Conduct Authority (FSCA), National Credit Regulator (NCR) and South African Revenue Service (SARS).

What is the Crypto Asset Regulatory Work Group (CAR WG)?

In 2018, IFWG members launched the Crypto Asset Regulatory Work Group (CAR WG) to help RSA regulators “formulate a coherent and comprehensive policy stance on crypto assets” whilst keeping its financial markets stable, protecting customers and deterring ML/TF cross-border financial flows.

How South Africa’s crypto assets regulations align with FATF’s Recommendations 15 and 16

The CAR WG paper references, in particular, the global AML watchdog Financial Action Task Force (FATF)’s Recommendation 16 (Wire transfers) and Recommendation 15 (New Technologies). South Africa is a member of both the FATF and its FATF-style regional body ESAAMLG.

South Africa proposes FATF Recommendation 16 travel rule for CASPs

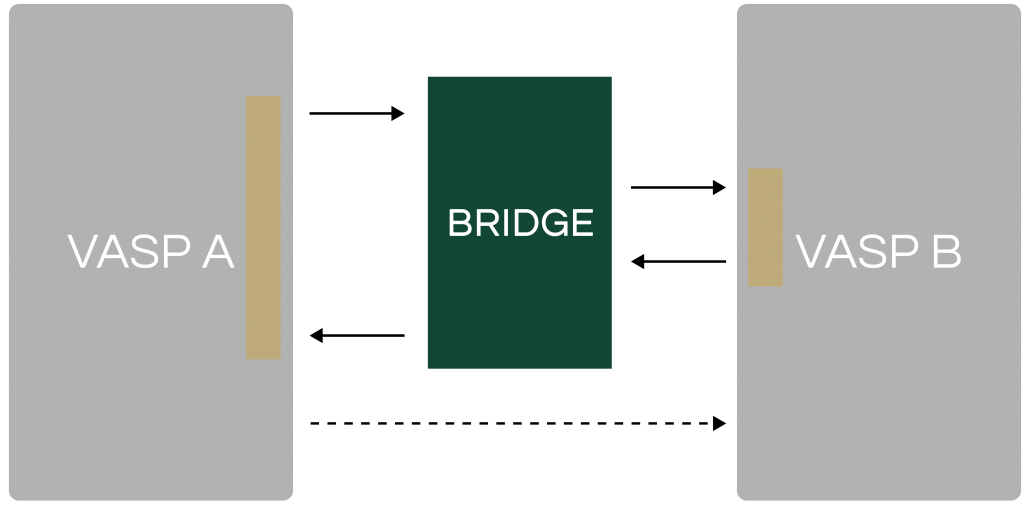

The FATF has set a June 2020 deadline for countries to introduce measures that forces domestic virtual asset service providers (VASPs) to adhere to its Recommendation 16 “travel rule”, a difficult new technical requirement that forces crypto exchanges to share beneficiary and originator transmittal information with counterparties. The term “CASP” is South Africa’s equivalent for FATF’s “VASP”.

(To learn more about the Sygna Bridge R16 Travel Rule solution, click here)

RSA regulators demonstrated their commitment to comply with FATF’s Recommendation 16, by including a section in the position paper that nearly mirrors the G20 AML watchdog’s official guidance.

According to section 8.4.2.2 of the CAR WG paper:

“CASPs will be required to implement Recommendation 16 (‘the travel rule’) of the FATF Recommendations.

The originating CASP should obtain, and hold, required and accurate originator information as well as required and accurate beneficiary information of the crypto asset transaction, submit this information to the beneficiary CASP or another obliged entity, and make this information available on request to the appropriate regulatory and/or law enforcement authorities.

The beneficiary CASP should obtain, and hold, required and accurate originator information as well as required and accurate beneficiary information of the crypto asset transaction, and make this information available to the appropriate regulatory and/or law enforcement authorities if and when requested to do so.

CAR WG’s position paper on Crypto Assets, April 2020

What are South African Crypto Asset Service Providers (CASPs)?

6 Types of SA CASPs to be regulated

The CAR WG’s April 2020 report identifies 6 types of crypto asset businesses who must register as Crypto Asset Service Providers (CASPs) in accordance with the FATF’s Recommendation 15 on New Technologies.:

- Trading platforms (CATPs) who buy, sell, trade, convert, remit, or exchange crypto to crypto or fiat, and vice versa.

- Vending machine provider: intermediary service to buy and sell crypto assets

- Token issuer: ICO and stablecoin issuers

- Fund/ derivative service provider: Companies that offer investment funds or derivatives with crypto assets as the underlying asset.

- Custodial digital wallet provider: Software-based products that store users’ private and public keys needed to manage and control their crypto assets.

- Custodial service provider: Entities that store, protect or maintain custody of another party’s crypto assets.

How must registered CASPs comply with the FIC Act?

CASPs will be treated as “accountable institutions”, similar to banks and traditional financial institutions, and will have to ensure they report cash transactions over R25,000, conduct strong Know-Your-Customer (KYC) and customer due diligence (CDD) checks on their users. CASPs will have to monitor and report suspicious transactions and keep accurate records.

If not, CASPs face administrative penalties by the FIC or stronger measures by authorities.

Why does South Africa need a strong crypto asset regulatory framework?

The CAR WG’s latest report aims to establish a strong regulatory framework in the RSA. This is to align South Africa with international anti-money laundering and counter-terrorism funding (AML/CFT) measures such as the Financial Action Task Force (FATF)’s crypto “travel rule” (discussed in the next section).

In the position paper, the IFWG justified their strict measures as follows:

“Crypto assets and the various activities associated with this innovation can no longer remain outside of the regulatory perimeter.”

South African authorities are especially concerned with the unchecked domestic spiking of crypto-asset ownership and transacting. These increasing unregulated activity can expose the African regional leader to various financial and political risks that it can ill afford and scupper recent improvements in mitigating AML/CFT risks.

Drivers for better crypto asset regulation

The position paper lists a few factors that drive the need for more tightly-knit regulation, as crypto assets:

- operate “within a regulatory void” as no “harmonized” global laws have been established

- may affect the country’s financial sector

- may create risky conditions for regulatory arbitrage

- may become systemic, as the crypto asset sphere evolves

CAR WG’s associated risks with crypto assets

The Crypto Asset Regulatory Working Group also identifies numerous cryptocurrency-associated risks:

- Risk of a parallel, fragmented, non-sovereign monetary system being created

- Lack of consumer protection, market inefficiency, and integrity risks

- Undefined legal and regulatory framework

- Illegal financial purchases and flows

- Money laundering and terrorism financing (ML/TF)

- Circumvention of exchange control regulations

- Market conduct risks posed by unregulated CASPs, such as Ponzi schemes, false advertising, and market manipulation

- Several risks with ICOs, such as exit scams, failure, and unregulated frameworks

- Risk of tax evasion

- Operational risk, such as cybersecurity threats

- Risk of tax evasion and a less effective national payment system

Which type of crypto use cases are targeted?

Crypto assets are defined by CAR WG as:

“a digital representation of value that is not issued by a central bank, but is traded, transferred and stored electronically by natural and legal persons for the purpose of payment, investment and other forms of utility, and applies cryptography techniques in the underlying technology.”

The position paper covers five distinct use cases for crypto assets, namely:

- buying and/or selling of crypto assets by consumers and legal persons;

- paying for goods and services with crypto assets;

- Initial Coin Offerings (ICOs);

- crypto asset funds and derivatives;

- crypto asset market support services.

CAR WG’s 30+ crypto asset regulation recommendations

The IFWG policymakers divides their 30+ recommendations for the implementation of new crypto asset regulations into 9 themes. Below are some of the most important proposals.

Theme 1: AML/CFT regulatory regime implementation (FIC & NT; 6-9 months)

- Align regulations with the FATF Standards’ recommendations

- An amended FIC Act section 1 to include CASPs as “accountable institutions”

- CASP must register with FIC and follow their regulatory requirements

Theme 2: Monitoring and analysis program implemented for crypto assets (IFWG and CAR WG, 6-9 months)

- Establish a reporting framework, data points, and platform for Crypto Asset Trading Platforms (CATPs)

Theme 3: Confirm legal status, prudential treatment, FMI interaction and taxing of crypto assets (SARS, SARB, NT and FIC)

- Crypto assets should not be considered as currency, legal tender or electronic money, as per the position paper of 2014.

- As the Prudential Authority, SARB should consider the appropriate regulatory and supervisory approach for the treatment of crypto assets for prudential entities and receive guidance from the BIS Basel Committee on Banking Supervision. (6-9 months)

- SARS and the NT should consider adopting a uniform definition of crypto assets

- SARB and FSCA must consider an appropriate policy stance on how crypto assets can be allowed to interact with financial market infrastructures (FMIs) (3-6 months)

Theme 4: Implementing a licensing and supervisory regime for crypto assets (FSCA and NT; 9-12 months)

- Crypto assets to be declared a financial service, and included in the licensing activities under the Conduct of Financial Institutions (COFI) Bill.

- CASPs must obtain a license from the FSCA and implement regulatory requirements

Theme 5: Cross-border regulatory framework implementation(SARB; 9-12 months)

- SARB’s Financial Surveillance Department should be responsible for monitoring cross-border financial flows related to crypto assets

- SARB should develop a process and system to help report crypto asset transactions.

- Crypto assets should be defined as capital

- Crypto asset trading platforms (CATPs) must get authorization from the SARB and implement regulatory requirements.

Theme 6: Payment system provider framework for crypto assets (SARB; 6-9 months)

- Under review

Theme 7: Framework for initial coin offering (ICO) tokens (FSCA and NT; dependent on token type and reviews)

- ICO issuances must be defined in terms of the specific token issued as a security, payment/exchange, or utility token.

Theme 8: Framework for crypto assets as derivative instruments (FSCA and NT; 9-12 months)

- Crypto assets should be allowed as underlying assets for alternative investment funds and derivative instruments.

Theme 9: Framework for crypto asset market support services (FSCA and NT)

- CASPs that provide safe custody and custodial digital wallets will be considered to provide financial services.

What’s next for South African crypto asset regulation in 2020?

The position paper’s recommendation will be submitted to the Minister of Finance for approval. Next, draft amendments will be published where the public can comment for 60 days.

Following the consideration of public comments, amendments will be reviewed and redrafted, then sent to the Minister of Finance for final approval, after which the process to get approval from Parliament will commence.

Following the very likely parliamentary approval of the country’s leading regulators’ recommendations, the Minister of Finance will publish the latest amendments in the Government Gazette.

Importantly for South African crypto asset service providers and users, the policy paper, while strict, should finally provide a clear regulatory landscape that should be FATF-compliant and become gradually more appealing for risk-averse institutional investors.