David Lewis FATF Executive Secretary

Introduction

With 2018’s crypto winter finally firmly in the rearview mirror, the crypto industry’s next big challenge reared its head early in 2019: Regulation.

After several barks at virtual asset transgressors in recent years, the Financial Action Task Force (FATF) finally delivered its first bite in February 2019- and it was a big one. FATF’s Interpretive Note to Recommendation 15 paragraph 7(b)-R16 introduced what many expected was inevitable- the so-called “Crypto Travel Rule” that will force exchanges to share the real-world identity of customers with each other to help support Anti-Money-Laundering (AML) and Combating Funding of Terrorism (CFT) activities. This followed increasing regulatory clarification and prosecutions by the U.S AML/CFT watchdog FinCEN.

Should the crypto industry be afraid of Recommendation 16?

So, does the cryptocurrency industry have a legitimate reason to fear increasing regulatory oversight? Well, yes and no.

Virtual assets are either pseudonymous (like Bitcoin) or anonymous (like privacy coins) and there is no built-in protocol in place that can automatically capture the real-world identities behind the alphanumeric strings which constitute a public address.

While during Bitcoin’s infancy this played a huge part in attracting libertarian-minded crypto users, it is now considered by most people as a weakness hampering the mass adoption of cryptocurrencies.

Nearly all substantial Bitcoin price jumps since 2018 can be attributed to events that signaled Bitcoin’s wider adoption, such as the Bitcoin Exchange-Traded Fund (ETF) attempts, Facebook’s Libra launch, and China’s new surprising pro-blockchain stance. When the aftershocks of these announcements peter out over time, cryptocurrencies inevitably lose steam drop again in value. Regulation that remedies weaknesses in cryptocurrency poses considerable short and long-term benefits to all stakeholders in the crypto industry.

The Current State of the Cryptocurrency Industry

Most of cryptocurrency’s early adopters love to wear their hearts on their sleeves, believing fervently that Bitcoin and other digital assets will wrench global financial power from the hands of big banks, right back into the hands of the masses. Regulation implies the exact opposite. Therefore, all regulation is bad and a sure way to kill the industry. Is this necessarily the case?

Interest in crypto

After its meteoric rise in late 2017, it seemed Bitcoin (and altcoins like XRP and Ethereum) had exploded into the public consciousness as the zeitgeist technology for the foreseeable future. Then followed the gloom of 2018, where the brutal bear market led many analysts to sound the death knell for the crypto industry.

Now, 2 years later, research shows that while the rumors of Bitcoin’s death have been greatly exaggerated at times, it’s not out of the water just yet.

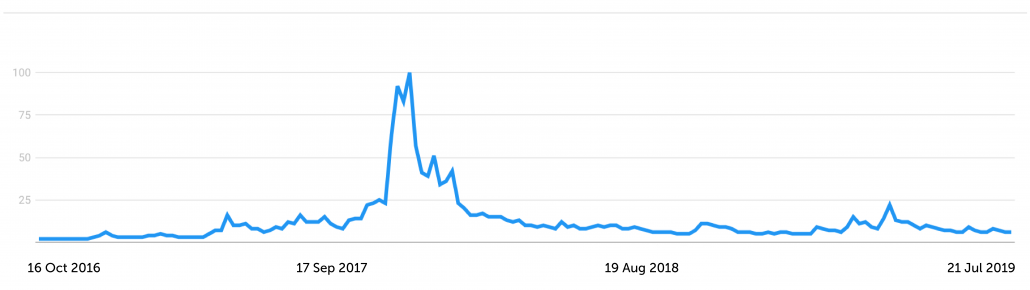

A Google Trends search for Bitcoin shows a dramatic drop in Bitcoin-related searches by the first half of 2018. Despite Bitcoin’s surge in 2019 from $4,000 to over $12,000 at one stage, this has not translated into dramatically stirring interest back up. Whichever way you want to spin it, this lack of interest in Bitcoin does not bode well for the crypto industry and is a clear indication that it may be fading into irrelevancy.

Bitcoin mainstream sentiments

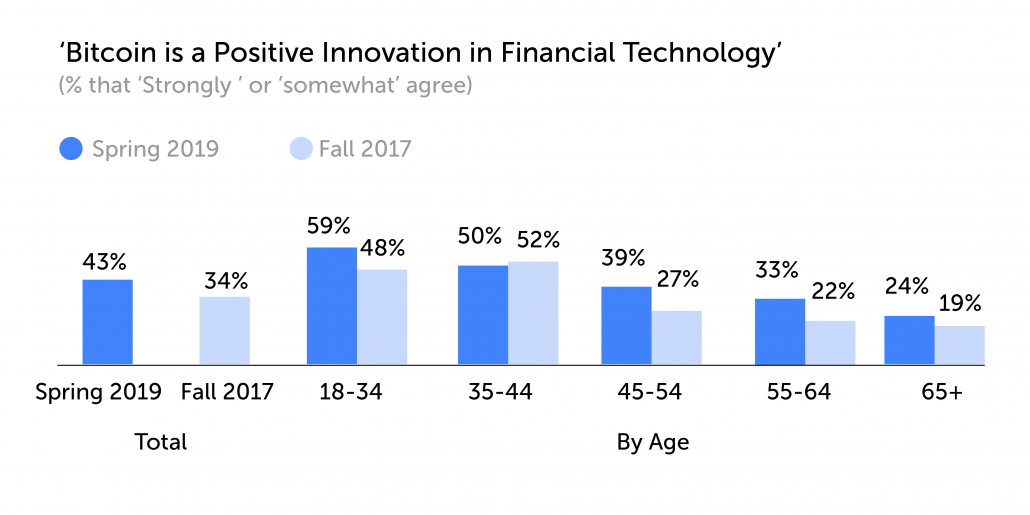

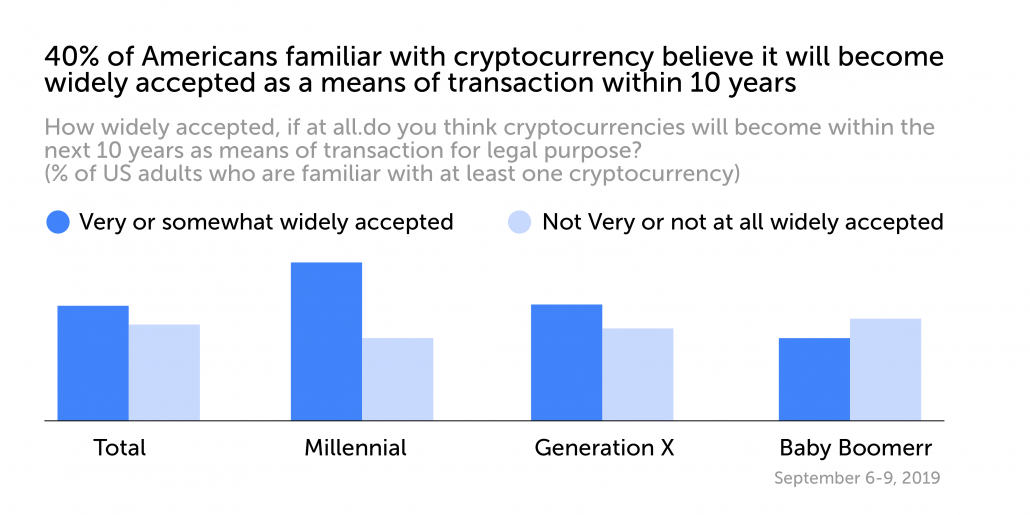

According to a September 2019 survey, about 8 in 10 (81%) American adults are familiar with at least one type of cryptocurrency, with 75% saying they’ve heard of Bitcoin. Also 2 in 5 U.S. adults (55% amongst millennials) believe that cryptocurrency will become widely accepted legal tender within the next decade.

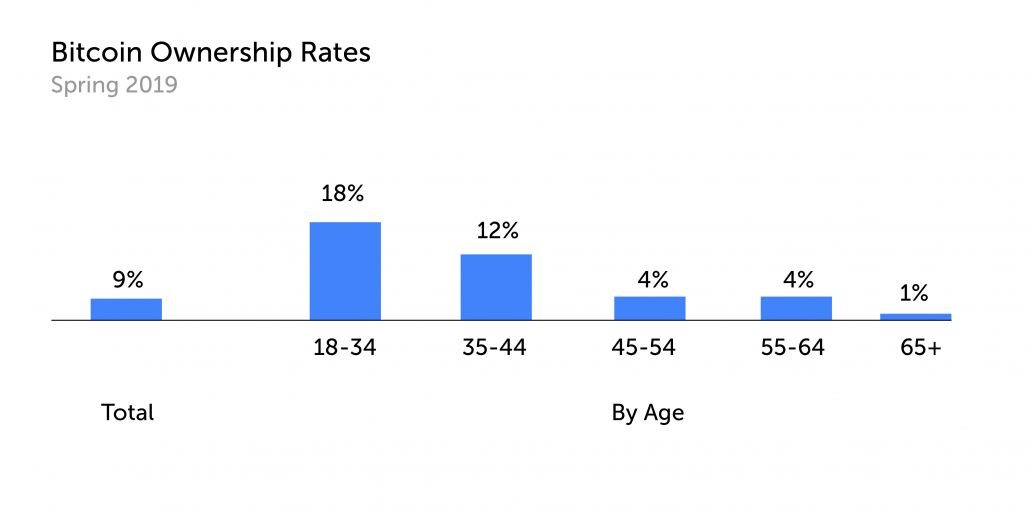

Another 2019 survey showed people overall viewed cryptocurrency a lot more positively and 9% of respondents owned Bitcoin.

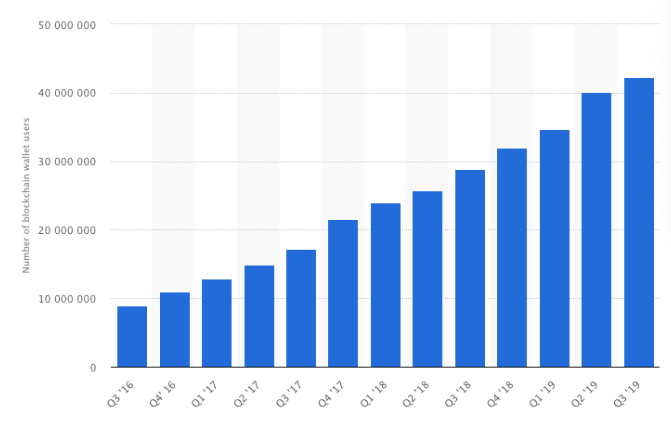

Furthermore, the number of blockchain wallet users has continued to climb throughout up and downs of the recent market.

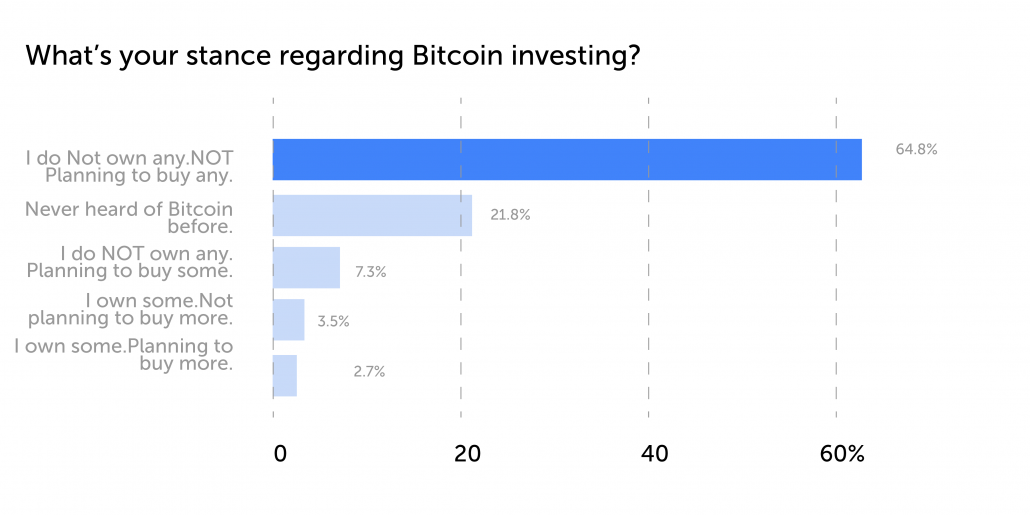

Yet, all these positive indicators and sentiments pale in significance when looking at the most important question: Will people invest in Bitcoin? This October 2019 study by Crypto Radar, paints a bleak picture from its 5000 respondents:

The research suggests that people under 35 have a higher risk tolerance to invest. However, trade war and global economic downturn predictions are making people act more cautious when investing, which makes Bitcoin’s high volatility less attractive. According to the study, the crypto industry needs to better communicate the many benefits the underlying technology offers to different industries, especially to older and female audiences.

Based on all these statistics, it is clear that while the mainstream audience now knows of cryptocurrencies like Bitcoin, and more people have started to own them, the majority of the world still don’t consider cryptocurrency a worthwhile investment. A clear-cut legal status and a less volatile price will make for a good start.

Traditional money vs the crypto industry

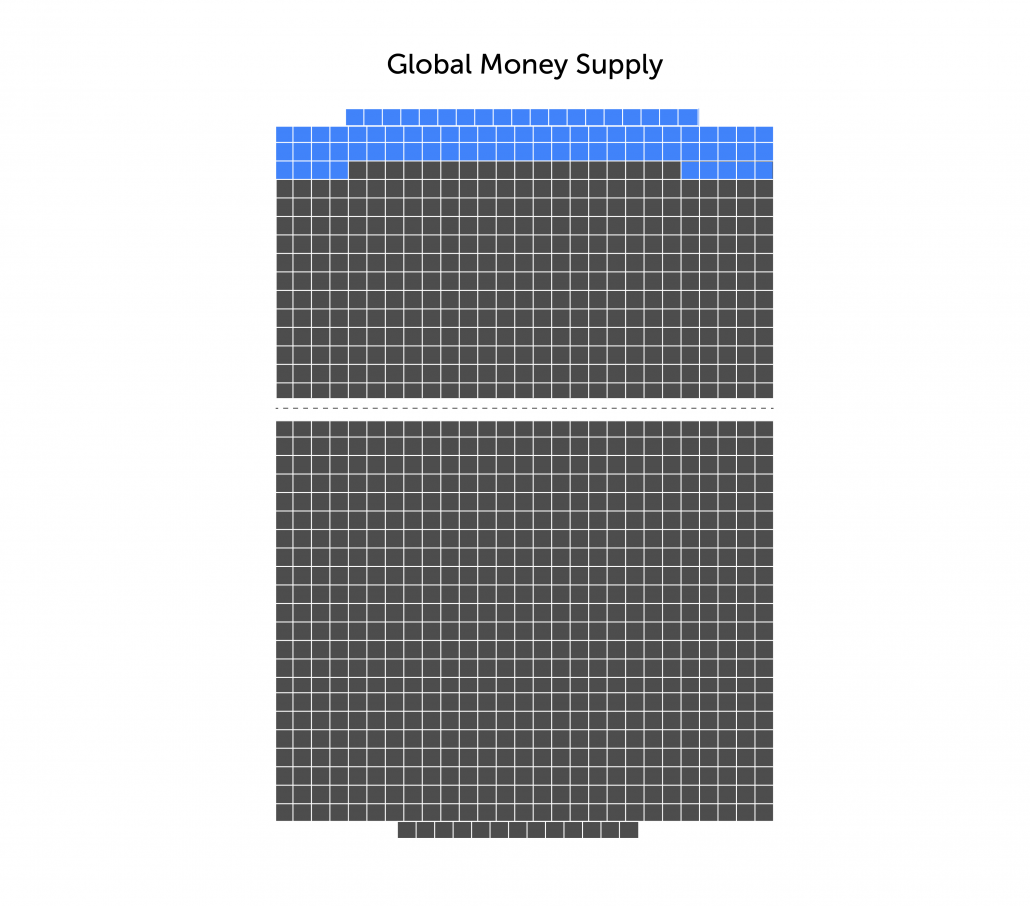

Below follows a visualization of the estimated “broad” global supply of money, which stands at $90 trillion and includes coins, banknotes, money markets, savings and checking accounts. It also excludes global debt and real-estate, each well over $200 billion. Each block represents 100 Billion U.S. dollars.

Now, pick two blocks. Any two blocks. That represents the entire crypto industry ($200 billion) at the time of writing in December 2019! It’s a mere drop in the bucket in the great current financial scheme of things.

Furthermore, current investment options like crypto hedge funds really drive home how young the industry still is, with only $1 Billion in assets under management (AuM), according to a 2019 PwC report. In 2018, Americans put an estimated $3.8 trillion in payments through credit cards alone. Over 7 in 10 Americans own a credit card.

It’s clear there is an incredible scope for growth in virtual asset usage. So how does the crypto industry carve up a bigger slice of the global money pie for themselves?

Regulation = Regular

While most people attribute the 2008 bank crash to the greed and negligence of big banks, the truth is a little more complicated, and indeed has more to do with unregulated loopholes that those in power exploited, according to Timothy Masad, ex-chairman of the Commodity Futures Trading Commission (CFTC):

What some Bitcoin enthusiasts fail to distinguish is that a primary cause of the global financial crisis was the growth of financial intermediation outside our traditional regulatory framework, rather than the mere existence of intermediation. Non-bank mortgage originators, securitization, derivatives, and the government-sponsored enterprises all contributed to dramatic growth in mortgage lending outside of traditional banks… There was, in short, no prudential regulation of the so-called shadow banking sector.

Regulation = Regular. It’s the antithesis of the chaos that virtual assets initially thrived in, and now seem to be bogged down by. Regulations establish order so that a system can function more consistently, safely, with mostly predictable outcomes. This means that in a more controllable environment, cryptocurrencies can be seen as a normal, less volatile risk that can be managed with sophisticated technology and have better protection.

Why and how can regulations benefit the crypto industry?

At present, over 50% of Americans own stocks, yet according to a 2018 poll, only 2% own Bitcoin. Over 1 in 4 U.S. residents are intrigued by cryptocurrency but won’t buy it anytime soon, as its price volatility, longterm legal status and barriers to purchasing remain prohibitive.

1. Regulation creates binary virtual asset ownership

Regulations like FATF’s Recommendation 16 and FinCEN’s MSB and BSA travel rule requirements will eventually divide crypto assets into two camps: regulated and unregulated.

By tying the real-world identities of crypto owners to virtual assets passing through compliant VASPs, the crypto industry will be able to clean up its act. Exchanges and regulators can better identify and isolate unsullied virtual currencies from those tainted by money laundering, terrorism funding, and other crime. All stakeholders will be able to gradually trace the origins of crypto as more verified real-world identities start to illuminate the blockchain. This will drive bad actors to underground marketplaces, where their virtual assets will either exist in a legal gray area or in clear violation of the law. This uncertainty will make unregulated assets less fungible and therefore lower in value.

Conversely, with regulatory requirements making the status of certain virtual assets (e.g. Bitcoin, stablecoins and privacy coins) and transmittal requirements binary, black or white, right or wrong, VASPs and financial institutions will be able to prove the bona fides of crypto under their custodianship, increasing its value as a long-term investment.

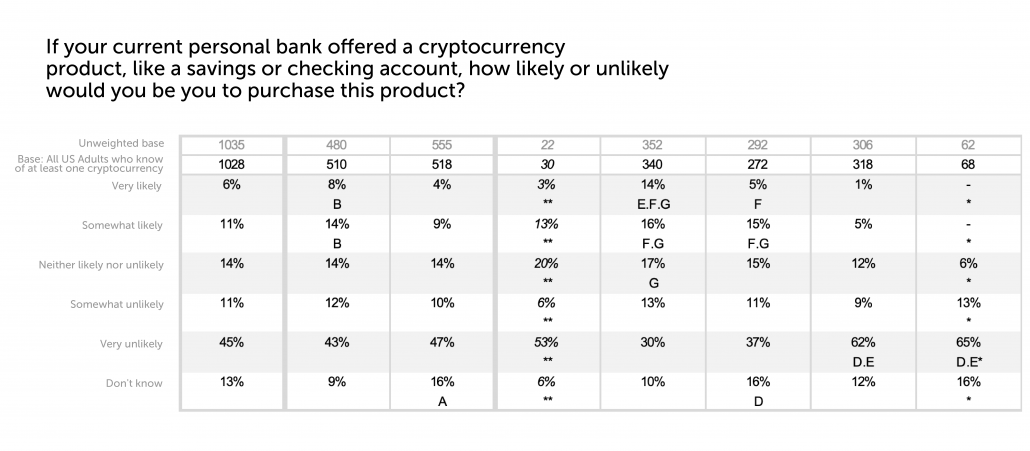

This is important not only for authorities but also for individual investors. A recent YouGov poll showed that the average American is very distrustful towards cryptocurrency, even if offered by a financial institution.

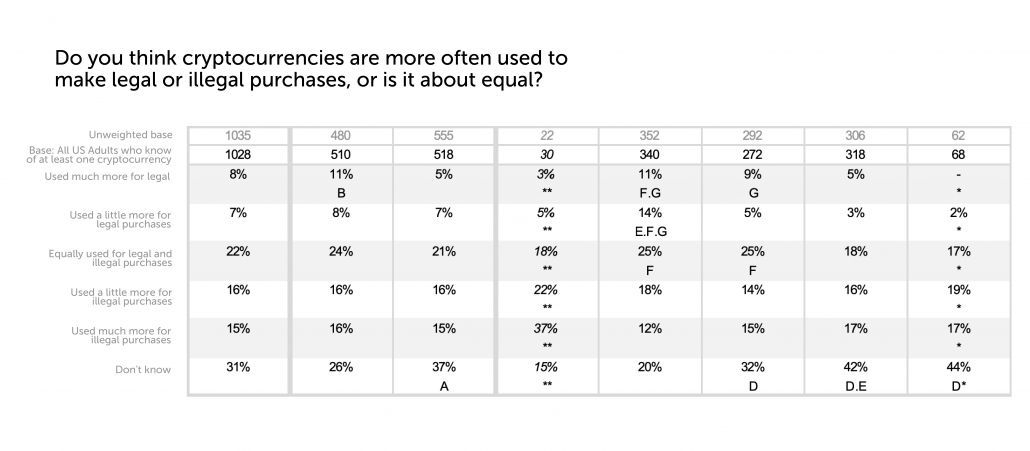

Furthermore, most U.S. adults believe that cryptocurrencies are more often than not used for illegal activity. Turning this misconception around should be a collective goal for the entire crypto industry, and regulation will make for a great ally.

2. Regulation makes virtual assets easy to categorize and understand

Presently, crypto-friendly financial institutions (FI’s) and banks are very rare. This can directly be attributed to the long-view legal uncertainty of virtual assets and the time-draining and costly AML/KYC compliance systems required, which is hampered even further by the lack of technical knowledge and ambiguous regulations that can be announced unexpectedly.

Only with clearer regulatory guidance can financial institutions start to shed light on gray areas and classify assets through a long-term lens, according to their legal status. This helps FI’s forego risk as long as they meet transparent rules and regulations ensconced in financial law. However, it’s still a long way off.

Already we can see the impact that regulation is having on the industry, with the recent delisting of several privacy coins from many Asian exchanges a clear indicator that VASPs are taking tough steps in order to get their house in order.

3. Regulation gives FI’s green light to invest

Authorities and financial institutions move notoriously slowly when it comes to technical innovation, thanks to outdated systems, bureaucracy, cross-border monetary restrictions and little financial impetus to change the status quo. This can be witnessed in the panicked knee-jerk reaction authorities and central banks worldwide had to the unveiling of Libra, a perceived threat to the global financial system that they were completely unprepared for.

For example, the SWIFT foundation was founded in 1973, but only went live with its messaging service in 1977 and expanded to Asian countries like Singapore and Hong Kong in the 1980s, after clearing several cross-border hurdles. Traditional finance is not intrinsically an industry that thrives on disruptive technology.

Regulation makes innovation easier to classify and therefore understand. Financially institutions need to clearly understand the landscape in which a new asset class operates, and the risk factors associated with it, before it can actively embrace and promote it. Under present circumstances, this is impossible.

While blockchain-tracking companies are doing an admirable job to trace the movement of illicit funds, it’s not enough. Financial institutions cannot operate and create financial instruments in a market where they cannot clearly determine the origins and clear the long-term legality of its underlying assets.

For example, if a bank sells Bitcoin to a client, which is later traced back to an exchange hack or act of terrorism either preceding or following the transaction, it opens itself up to criminal investigations or class-action lawsuits that could result in its demise. In a financial industry where an institution like Barings Bank met its demise directly due to the fraudulent behavior of a single trader and 465 banks ceased trading in the aftermath of the 2007-2008 banking crisis, financial institutions are increasingly averse to risk-taking and stepping into gray areas.

The effective regulation of the cryptocurrency industry will transfer maturity, stability, and fungibility to all compliant virtual assets, raising their appeal to institutional and individual investors who will start to view them as a legitimate long-term investment, instead of a short-term speculative opportunity.

4. Regulation puts an accurate valuation on a cryptocurrency’s worth

No, I didn’t say raise the price. A high cryptocurrency price is not necessarily a good thing. Bitcoin’s parabolic climb in late 2017 led to a cataclysmic price retrace in which investors faced massive losses due to an over-valuation, market manipulation, and outright scams. Many virtual asset service providers helped to facilitate these Wild West conditions.

A regulated marketplace, where real identities can be tied to illicit behavior by authorities, creates a more level playing field for all crypto investors. Fake buy and sell orders and collusion to generate “pump and dump” action will be harder to get away with. Cryptocurrencies will be judged on their merits by the market and be subject to purer supply and demand economic forces. A bigger investor pool will create stability by providing liquidity, which will have the knock-on effect of reducing volatility in favor of reliable long-term price predictability. Growth will be organic and business fundamentals will allow investors to more accurately determine the underlying value of virtual assets.

5. Regulations will help transform cryptocurrency from purely speculative to usable assets

Knowing the parameters in which they can operate, cryptocurrency projects will be able to move beyond current tightly-controlled pilot programs and sandbox testing and offer Big Business customized solutions to existing problems without having to fear a backlash from regulators.

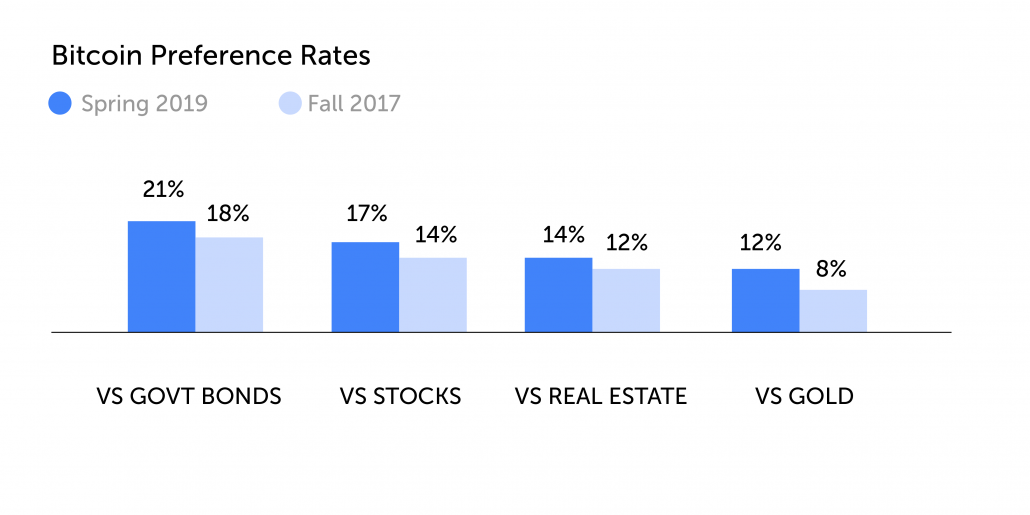

The lack of current regulations limits the use cases of most current cryptocurrencies as mostly theoretical, in the absence of practical validation. Large corporations are fearful to implement virtual assets into their operations, worried about attracting the kind of condemnation that Libra received. However, if they’re looking towards the future, they should millennial users have a higher threshold for risk. In a Blockchain Capital survey in 2017 and 2019 that asked what you would invest in with $1000, results showed across the board that Millenials increasingly prefer Bitcoin over traditional investment options.

Financial institutions are already integrating blockchain technology into the very fabric of their operations, as can be seen by permissioned distributed ledger technology (DLT) implemented by the likes of JP Morgan and Wells Fargo. By gaining regulatory approval, they will also be able to develop specific financial instruments that will result in more fungible assets.

6. Regulation will make virtual asset ownership more secure

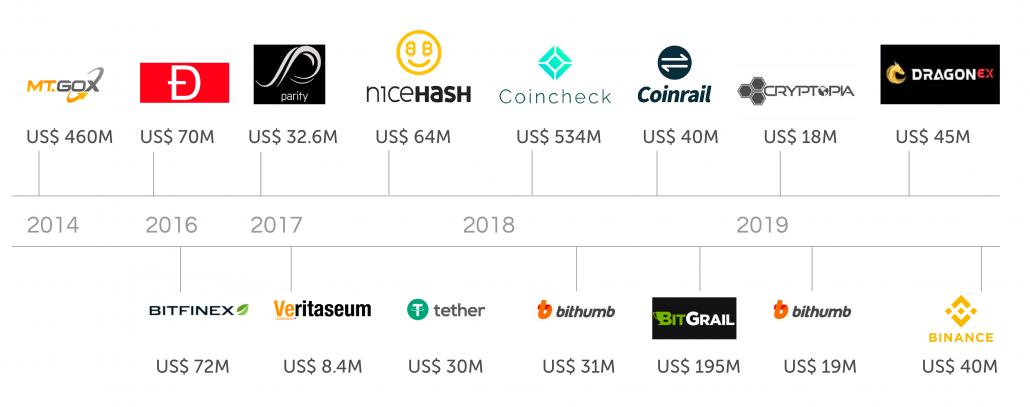

The 2017 Bitcoin bull run was fuelled by largely misinformed casual new entrants who were looking to see their investments “go to the moon”. In hindsight, that’s exactly where their investments went. The cryptocurrency landscape of 2018-2019 indeed resembles the moon. It’s littered with unregulated, crater-sized security holes in which over $1.7 billion in 2018 and $4.3 billion by mid-2019 in crypto assets disappeared by way of increasingly sophisticated exchange and wallet hacks, scams and NSA-level malware threats. Is this really what Satoshi Nakamoto envisioned?

Users are as guilty as their virtual asset service providers (VASPS). Instead of creating a decentralized financial utopia, their over-reliance on VASPs created a new class of financial intermediaries that are less accountable than big banks and other financial institutions and operate in murky conditions.

Clear and actionable regulations will pave the way to a much-needed control layer for virtual asset custodians and owners. VASPs will be able to reject undesired or suspicious transaction requests, freeze irregular transmittals in transit or even reverse malicious transmittals after the fact if illicit behavior or purposes such as human trafficking can be established by law enforcement.

Compliant VASPs will have the ability to collectively verify and cross-check the real identities and intentions behind public addresses, passing this information over to authorities when required. Governments like North Korea will be less willing to sponsor hacker groups such as the Lazarus group, for fear of getting blacklisted or pursued by AML/CFT watchdogs like FATF and FinCEN. Bad actors and exit scam con artists will know that if their crimes are successful, they will still leave a trail of breadcrumbs that might follow them for the rest of their lives.

Lastly, the technological advances in security thanks to the arrival of sophisticated financial institutions will be tremendous.

7. Regulation encourages investment into research and development

The expected influx of financial institutions into a regulated cryptocurrency space should result in a massive “brain gain” to the entire industry. FI’s will bring with them some of the most skilled professionals in the world in the fields of banking, FinTech and digital security, as well as mature, enterprise-ready solutions and infrastructure that have been battle-tested and undergone many iterations to ensure reliable stability, security and overall functionality. AML-compliance is also much more mature and sophisticated in traditional finance, and there will be no shortage of AML specialist companies that VASPs will be able to consult with in order to identify bad actors worldwide.

8. Regulation improves the efficiency of virtual asset trading

Regulated crypto markets will future-proof compliant virtual asset transmittals and allow it to be sent to almost any regulatory-compliant destination in the world. VASP users will likely no longer be required to undergo frustrating and time-consuming KYC registrations every time they open an account. Instead, a universal virtual asset profile, tied to their real identities, can be created for users.

VASP users will also finally be able to put more trust in their chosen exchanges and wallet custodians. Thanks to much more resilient security and industry checks and balances, no longer will custodial institutions be able to pilfer their coffins and claim that the disappeared funds are the result of unexplained security breaches. Traders will have less need to diversify risk and be more willing to keep a bigger portion of their portfolios exclusively in cryptocurrency instead of fiat, as less price volatility, better security, and fiat-backed, regulated stablecoins will offer them the same protection as physical currencies.

Conclusion

While it is completely understandable that a large contingent of the cryptocurrency industry views impending regulations like FATF’s crypto travel rule as a death knell to both the crypto-verse and their personal financial privacy, it’s a very myopic point of view. Ultimately the benefits that regulation brings will vastly outweigh its negatives over the long run. In any case, it’s a moot point. Following June 2019, regulation is here to stay for good, as a recent joint warning by the SEC, FinCEN and the CFTC and the latest comments from FinCEN director Kenneth Blanco demonstrate.

“You have to make sure that you comply with the law first and then you can execute and get to market. Otherwise, that’s not happening … I’ll tell you if you can’t comply with your BSA, you’re going to have a problem … you must comply and we as a regulator, as the primary regulator and the administrator of the BSA, we make sure that you do and you’re going to have a hard time if you don’t…Any firms which do not believe they are able to fulfill the requirements in the BSA should not come to market.”

Kenneth Blanco,FinCEN director

The stakes and rules are therefore very clear. Regulators are the gatekeepers to mass adoption. If we want the crypto industry to keep growing and prosper, we need to ensure that a significant portion of the world’s population has access to and faith in it. To make this a reality, virtual assets like Bitcoin must be viewed as secure, easy-to-use and readily available globally.

As Timothy Massad, former CFTC chairman says in his article “It’s Time To Strengthen to Regulation of Crypto Assets”:

“…Industry participants should tone down their rhetoric about the utopian future that cryptoassets might bring and focus on the development of self-regulatory standards. Those standards can help shape sensible regulation and will be an important complement to government oversight.”

In order to achieve mass adoption that truly disrupts the global economy to create a level playing field for all countries and users, regulation is essential. Financial institutions and mainstream investors seek order and a controlled environment in which to conduct business. Regulation shouldn’t be the death knell of the crypto industry, in fact, it should signal the start.

It is up to the cryptocurrency industry now to move past their differences, big-fish-small-pond mentality and create a unified front to help dictate the terms and conditions of its future. Welcome to the big league, crypto. Now is our chance to change the world.