After the lightning-fast prime ministerial term of Liz Truss, the UK’s Rishi Sunak has assumed office – the youngest PM in over 200 years and the first who is not white. However, excitement over the novelty of Sunak’s background has been tempered by his standard Tory pedigree and the fact that he is worth over $800M.

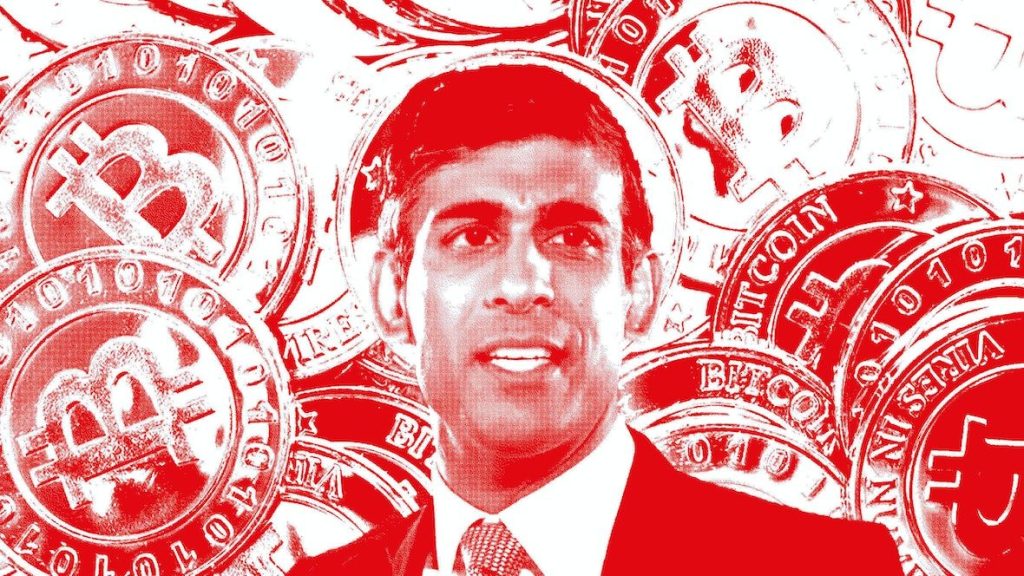

Nonetheless, one group of people excited about Sunak appears to be crypto enthusiasts, who are cautiously optimistic that he is one of their own. Sunak is reportedly a “fintech evangelist,” according to one crypto exchange executive. In the past, he has pushed for crypto’s regulatory inclusion in the UK as well as even for the Royal Mint to issue a non-fungible token (NFT).

Let’s take stock of the new PM’s crypto stance and see what we can glean about his intentions.

UK to be a new “Global Crypto Hub”?

Under former Prime Minister Boris Johnson, Sunak was chancellor of the Exchequer from early 2020 until July of this year. In that role, he was seen as a staunch advocate for crypto.

In April, just a few months before stepping down, Sunak said that it was his ambition to make the UK into a global hub for crypto. He added that this was part of his vision to see the UK’s financial services industry remain in the lead of technology and innovation.

At that same time, Sunak instructed the Royal Mint to create an NFT “as an emblem of the forward-looking approach the UK is determined to take.” Sunak commissioned the NFT to be ready by the end of this year.

Sunak and CBDCs

The prime minister has been a strident advocate for central bank digital currencies (CBDCs), though it’s too soon to say whether he will implement one while in office. While at the Exchequer, Sunak asked the Bank of England (BoE) to look into the possibility of starting a CBDC, which he termed “Britcoin.” Shortly thereafter, an exploratory task force on CBCDs was launched between the Exchequer and the BoE.

Financial Services and Markets Bill

As chancellor of the Exchequer, Sunak was responsible for the drafting of the Financial Services and Markets Bill, which was meant to create a regulatory schema for stablecoins and create some clarity for the crypto industry. The legislation is currently winding its way through the upper house of Parliament after passing in the House of Commons.

From the initial draft, the bill was meant to build a “financial market infrastructure sandbox” that would allow for experimentation in the crypto sector. It was also intended to bring stablecoins inside the UK’s regulatory remit and initiate tax reforms to boost the competitiveness of the industry.

In October, well after Sunak stepped down from his role at the Exchequer, an amendment was introduced to widen the scope of the bill. With this amended version that has already passed in the lower house, the bill’s scope has broadened beyond just stablecoins to include something called “crypto assets,” which are defined under the bill’s Provision 14.

The new definition brings these assets into the domain of the Financial Services and Markets Act of 2000, making it easier for the UK to regulate crypto advertisements as well as ban unlicensed crypto entities operating in the country. The amendment will also open the door for the Treasury and Financial Conduct Authority (FCA) to implement a comprehensive regulatory framework for crypto.

Scottish MP Lisa Cameron, of the Crypto and Digital Assets All Party Parliamentary Group, has called on Sunak to clarify the British government’s level of commitment to the crypto industry.

The PM has so far declined to do so in his new role.