Table of Contents

*UPDATE: New March 2020 proposed changes

1. OVERVIEW: Crypto-Currency Act of 2020

2. SECTION-BY-SECTION: The Crypto-Currency Act of 2020

- Section 1: Name

- Section 2: Definitions of Digital Asset and Federal Regulators

- 1. What is a crypto-commodity?

- 2. What is a crypto-currency?

- 3. What is a crypto-security?

- 4. What is a “decentralized cryptographic ledger”?

- 5. What is a “decentralized oracle”?

- 6. What is a “digital asset”?

- 7. What is an “insured depository institution”?

- 8. What is a reserve-backed stablecoin?

- 9. What is a synthetic stablecoin?

- 10. What is a smart contract”?

- 11. What are “Primary Federal Digital Asset Regulators”?

March 2020 updates on “Crypto-Currency Act of 2020”

On 9 March 2020, U.S. Congressman Paul Gosar (Rep-Arizona), quarantined by the coronavirus, delivered an updated draft of the Crypto-Currency Act of 2020 to the House.

The March version 2020 significantly reworks his leaked December draft paper and:

- further iterates on its key concepts and puts an emphasis on regulating stablecoins

- renames “Federal Crypto Regulator” to “Primary Federal Digital Asset Regulator”

- introduces and clearly defines “decentralized cryptographic ledger” and “smart contract” to help lawmakers understand the underlying technology

- defines “insured depository institution” according to existing legislation

- reworks existing definitions such as “crypto-currency” by including the new terms to clarify gray areas and to bring stablecoins such as Tether under its scope.

- now assigns crypto-currency regulation to the Treasury Secretary by way of FinCEN AND the Comptroller of the Currency

Mr. Gosar’s latest efforts follows on his work during December 2019, where he first introduced the new draft bill to U.S. Congress to help guide how U.S. lawmakers will oversee and regulate virtual assets in the new decade.

This followed a tumultuous year for cryptocurrencies that saw the introduction of the Financial Action Task Force’s Recommendation 16 “travel rule”, the announcement of Facebook’s controversial Libra stablecoin, as well as increasing action from the Financial Crimes Enforcement Network (FinCEN) and other U.S. regulators.

1. Overview: Crypto-Currency Act of 2020 ( TL;DR)

In short, the Crypto-Currency Act of 2020 proposes the following:

1. It divides digital assets into 3 different categories:

- Crypto-currency: blockchain-based “representations of United States currency or synthetic derivatives”

- Crypto-commodity: blockchain-based “economic goods or services with substantial fungibility”

- Crypto-security: blockchain-based “debt, equity, and derivative instruments”

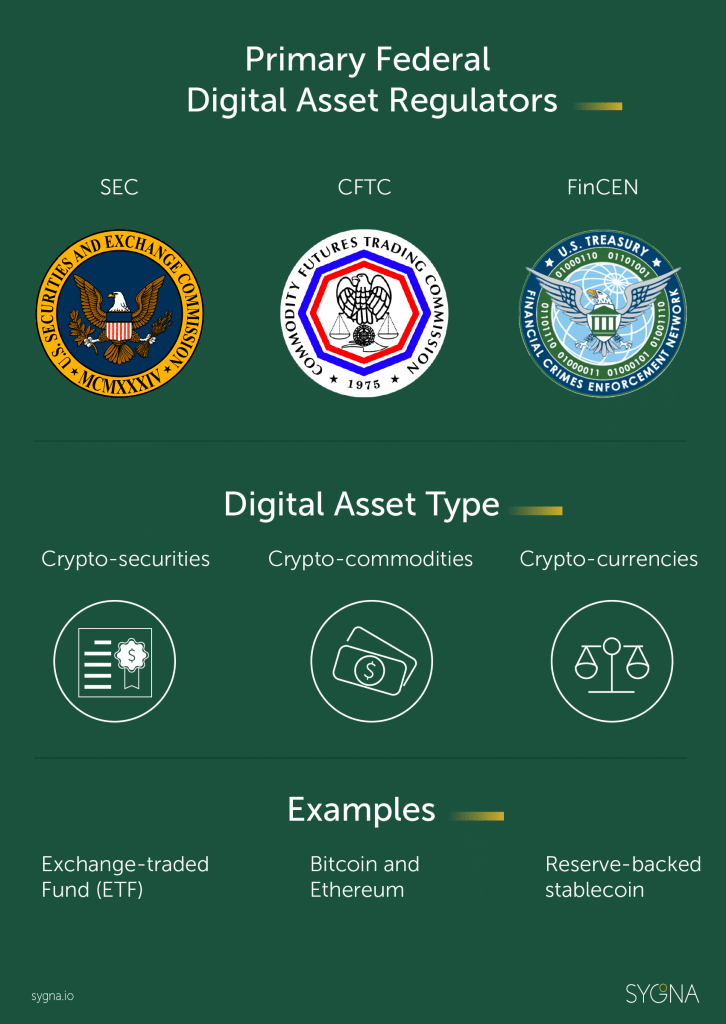

2. It defines 3 U.S. regulatory agencies as “ Primary Federal Digital Asset Regulators”

- Secretary of the Treasury, acting through the Financial Crimes Enforcement Network (FinCEN) and Comptroller of the Currency (OCC)

- Commodity Futures Trading Commission (CFTC)

- Securities and Exchange Commission (SEC)

3. Each defined federal regulator is assigned a digital asset with sole authority

The Financial Crimes Enforcement Network (FinCEN) will regulate crypto-currencies, the Securities and Exchange Commission (SEC) will take charge of crypto-securities, while the Commodity Futures Trading Commission (CFTC) will handle all defined crypto-commodities.

4. The Rest

- The three regulators are required to retain and share an up-to-date list of current Federal licenses, certificates and registrations with the public that are needed to create virtual assets or trade them.

- The Act mandates the Treasury Secretary, Mr. Steven Mnuchin, an outspoken critic of unregulated cryptocurrencies, to create regulation by way of FinCEN to help track the transactional flow of cryptocurrencies.

- It essentially defines“stablecoins” as “crypto-currencies” and divides them into reserve-backed stablecoins (backed 1:1 by a real-world asset in a bank account) and synthetic stablecoins (not reserve-backed).

- It also defines a “Decentralized Oracle” for services that transmit or verify external data outside of a blockchain to help execute smart contract functions.

What is the Crypto-Currency Act of 2020’s purpose?

To bring “regulatory clarity to cryptocurrencies”.

On 20 December 2019, U.S. Congressman Mr. Paul Gosar (Arizona Republican) introduced the draft bill in secret to the House of Representatives in order to bring “regulatory clarity” to cryptocurrencies. This entailed defining various types of digital assets and assigning federal regulators to police digital assets that fall in their jurisdiction.

2. The Crypto-Currency 2020 Act: Section by Section

Section 1: Name

The opening part of the Act declares that it “ may be cited as the Crypto-currency Act of 2020”.

Section 2: Definitions- Digital Assets & Regulators

The second part of the Act clearly distinguishes between the different types of digital assets, crypto federal regulators as well as stablecoins.

1) What is a “crypto-commodity”?

Crypto-commodities are defined as

- 1) “economic goods and services” that have

- 2) some type of “substantial fungibility”, which

- 3) the markets deal with irrespective of who produced these goods and services and

- 4) which reside on a “ decentralized blockchain or cryptographic ledger”.

So pretty much, Bitcoin and other conventional cryptocurrencies.

2) What is a “crypto-currency”?

Described by the proposed draft as “representations of United States currency or synthetic derivatives resting on a blockchain or decentralized cryptographic ledger”, the “crypto-currency” definition seemingly now refers to USD stablecoins such as Tether (USDT), Gemini Dollar (GUSD), True USD (TUSD) and other qualifying stable assets. Specifically, it includes:

- Reserve-backed digital assets that are completely collateralized in a corresponding bank account, backed by real-world assets in a 1:1 ratio.

- Synthetic derivatives which are “determined by decentralized oracles or smart contracts and collateralized by crypto-commodities, other crypto-currencies or crypto-securities. “

Interestingly, the definition appears to categorize reserve-backed stablecoins such as Libra as a crypto-currency. The proposed draft adds:

“The Secretary of the Treasury, acting through FinCEN, shall issue rules to require each crypto-currency (including synthetic stablecoins) to allow for the tracing of transactions in the crypto-currency and persons engaging in such transactions in a manner similar to that required of financial institutions with respect to currency transactions,”

3) What is a “crypto-security”?

A crypto-security is defined by the Crypto-Currency Act of 2020 as “all debt, equity, and derivative instruments that rest on a blockchain or decentralized cryptographic ledger”.

However, the definition excludes synthetic derivatives that operate and are registered as money service businesses (MSBs) in compliance with the Banking Secrecy Act (BSA) and other federal AML/CFT regulators such as FinCEN and OFAC (the Office of Foreign Assets Control).

A crypto-security in the U.S. law can broadly be defined as a digital asset that passes the Howey Test (created by the Supreme Court in 1946 in a landmark case) and are therefore subject to securities regulation if it fulfills these requirements:

- It is an investment of money

- There is an expectation of profits from the investment

- The investment of money is in a common enterprise

- Any profit comes from the efforts of a promoter or third party

The updated March 2020 Crypto-Currency Act of 2020 now defines “decentralized cryptographic ledger” as a ledger that:

- runs as a stand-alone blockchain secured through a minting process, such as Proof-of-Stake (PoS), where rewards are issued based on users’ “stakes”, or Proof-of-Work (PoW) where miners are issued rewards for verifying transactions.

- runs as a cryptographic asset or smart contract on the said existing stand-alone blockchain

- is immutable and cannot be altered without a controlling stake

- must cryptographically link its blocks

- is permissionless and doesn’t require third parties to transact

- is an “irreversible bearer commodity”

- cannot be controlled by a single entity

- is not issued by a country (“nation-state”) or private entity

5) What is a “decentralized oracle”?

“The term ‘‘decentralized oracle’’ means a service that sends and verifies real-world data from external sources outside of a blockchain and submits such information to smart contracts that rest on the blockchain, thus triggering the execution of predefined functions of the smart contract. “

6) What is a “digital asset”?

The Crypto-Currency Act divides digital assets (also known as virtual assets) into 3 distinctly different categories:

- Crypto-commodities

- Crypto-currencies

- Crypto-securities

7) What is an “insured depository institution”?

The draft bill defines “insured depository institution” as per section 3 of the Federal Deposit Insurance Act.

8) What is a reserve-backed stablecoin?

To further define this “crypto-currency”, the Act defines reserve-backed stablecoins as a

- representation of a U.S or foreign government-issued currency

- residing on a blockchain or decentralized cryptographic ledger

- is collateralized 1:1 by the represented currency

- which must be deposited in an insured depository institution

9) What is a “synthetic stablecoin”?

A synthetic stablecoin is defined as a digital asset (not a

reserve-backed stablecoin) that is stabilized versus the value of another currency or asset and resides on a blockchain or decentralized cryptographic ledger.

10) What is a “smart contract”?

The term ‘‘smart contract’’ refers to a computer protocol that intends to:

- digitally facilitate, enforce or validate the negotiation or performance of a contract

- enable the “performance of credible transactions without third parties”

11) What are “Primary Federal Digital Asset Regulators”?

What is a “Primary Federal Digital Asset Regulator” according to the Act?

The term ‘‘Primary Federal Digital Asset Regulator’’ means:

- (A) the Commodity Futures Trading Commission (CFTC), with respect to crypto-commodities;

- (B) the Secretary of the Treasury, acting through the Financial Crimes Enforcement Network (FinCEN), and Controller of the Currency with respect to crypto-currencies;

- (C) the Securities and Exchange Commission (SEC), with respect to crypto-securities.

Section 3: Primary areas of regulatory oversight for digital assets

In its third section, “Establishing Areas of Regulatory Oversight for Digital Assets”, the Act allocates regulatory duties as follows:

(a) CRYPTO-COMMODITIES.—The Commodity Futures Trading Commission shall be the sole Government agency with the authority to regulate crypto-commodities.

(b) CRYPTO-CURRENCIES.—The Secretary of the Treasury, acting through the Financial Crimes Enforcement Network, and the Comptroller of the Currency shall be the primary Government agencies shall be the primary Government agencies with the authority to regulate crypto-currencies (other than synthetic stablecoins).

(c) CRYPTO-SECURITIES.—The Securities and Exchange Commission shall be the sole Government agency 20 with the authority to regulate crypto-securities and synthetic stablecoins.

The CFTC to regulate crypto-commodities

For the Commodities Futures Trading Commission, if the bill is accepted then it means that the CFTC will have to regulate and develop a framework for the crypto-commodity asset class, which is expected to boom in the coming years, from scratch.

New chairman Heath Tarbert, sworn in during June 2019, already made his voice heard in October last year by confirming that Ethereum is also a commodity and not a security in the eyes of the CFTC, which supports the organization’s viewpoint since 2015 that they consider virtual currencies like Bitcoin, the world’s most popular digital asset, to be commodities.

These new powers will strengthen the CFTC chairman’s hand in the future when it comes to clearly demarcating the CFTC’s area of regulation.

The SEC to regulate crypto-securities

Crypto-securities on the other hand, will stay under the wary gaze of the Securities & Exchange Commission. The hands-on SEC has in recent years turned down every single Bitcoin exchange-traded fund (ETF) application and started to crack down on “illegal” security offerings such as the ICO boom in 2017 and went after EOS creator Block.One in 2019 with a $24million settlement.

However, the SEC chairman Jay Clayton laid the Ethereum community’s fears to rest in September 2019 by stating that the world’s second-biggest cryptocurrency is indeed “definitely not a security”.

FinCEN to regulate crypto-currencies

Meanwhile, FinCEN will regulate crypto-currencies used in transactions as types of virtual money in accordance with their AML/CFT policy as well as established KYC protocols.

Most importantly for regulators, they want to devise a method to trace the real identities behind virtual currency transactions, in order to clamp down on money laundering and terrorism funding.

This is in line with more responsibilities that the U.S. Congress has bestowed on FinCEN last year.

For example, in September 2019 the House of Representatives approved the bill “Advancing Innovation to Assist Law Enforcement Act” to allow the incumbent FinCEN director to undertake a study within the agency on how emerging technologies such as blockchain are used.

In 2019 FinCEN took a strong stance against unregulated cryptocurrency transacting with their May 2019 CVC Guidance, which tied together nearly a decade of crypto rules and regulations.

The agency’s director Mr. Kenneth A. Blanco also made it very clear that money service businesses (MSBs) that deal with crypto and do not follow the Banking Secrecy Act (BSA) will be targeted.

In October Mr. Blanco foreshadowed the proposed Act and its focus on stablecoins, by declaring that stablecoin issuers are “money transmitters” and therefore subject to the BSA’s so-called Travel Rule. In December 2019 Mcor. Blanco expressed his satisfaction with how crypto businesses were responding to regulations. With this new regulatory carte blanche from the U.S. Congress, expect FinCEN to make bold moves in 2020 against crypto-dealing money service businesses who break BSA regulations.

Graph: Federal Crypto Regulators vs Digital Assets

Section 4: Registration and Public Lists of Digital Asset Exchanges

Each Federal digital asset regulator shall, with respect to digital assets regulated by the Federal digital asset regulator, make available to the public (and keep current) a list of all Federal licenses, certifications, or registrations required to create or trade in digital assets. “

Section 5 (new): Availability of Information to the Public on Requirements to Create or Trade in Digital Assets

Each primary regulator should list all Federal licenses, certifications or registrations needed to create or trade in a related digital asset.

Section 6: Requirements related to Crypto-currencies

According to the proposed bill, the Secretary of the Treasury by way of FinCEN must establish rules for

- Transaction-tracing mechanisms

- Reserve-backed state audits

- Transition of stablecoins: if any event (e.g. dilution) forces a stablecoin to change from reserve-backed to synthesized, and vice versa, the primary regulator must be notified.

Conclusion:

The March 2020 update to the Cryptocurrency Act of 2020 further refines the December proposal and hones in carefully on stable-valued assets, which seems to be its primary target.

There is no official date for its proposal to or possible adoption by the U.S. Congress yet determined, however, the Crypto-Currency Act of 2020 is expected to come to a vote at some time this year.

This follow-up initiative to the Token Taxonomy Act of 2019 (which aimed to bring Libra under the oversight of the SEC) seems to be a new attempt to further clarify the regulation of cryptocurrencies in the United States, which due to the complex interaction between the multitudes of government agencies are slow to adapt to disruptive new challenges that cryptocurrencies pose.

At a minimum, it shows that lawmakers are now increasingly viewing cryptocurrencies as both a viable asset class and a serious threat to the financial status quo if not managed correctly.

While these regulations and legislation can be tough for outsiders to digest, cryptocurrency investors and supporters can take heart. By increasingly regulating digital assets like traditional assets, authorities are helping to make them more palatable for mainstream investors. In this context, regulation may, in fact, be a key component of not just the survival but also the prosperity of digital assets in the coming years.

Written by Werner Vermaak

About CoolBitX and Sygna Bridge

CoolBitX’s Sygna Bridge is a first-to-market travel rule solution and alliance network that is live and being used by our VASP partners to share compliant originator and beneficiary transmittal information.

Sygna Bridge completed a successful production test report (Big 4 audited) earlier this year, which was presented to the FATF Contact Group in May 2020. Sygna Bridge now also supports the IVMS101 messaging standard.

CoolBitX has signed MoUs with 18 VASPs worldwide and recently joined forces with Elliptic in a combined quest to help crypto companies comply with the FATF Standards.

For enquiries on the FATF Travel Rule and our Sygna Bridge solution for VASPs, please contact us at info@sygna.io.