- Overview (TL:DR)

- What is the Office of the Comptroller (OCC)?

- How did the OCC clarify its existing crypto custody policy?

- The OCC clarifies banks’ crypto custody- 5 key points

- Who does the OCC clarification apply to?

- Benefits of the OCC’s new crypto custody stance

- When will U.S. banks begin to offer crypto custody services?

- Conclusion

Overview: OCC’s Crypto Custody Clarification (TL:DR)

The United States’ Office of the Comptroller (OCC) last month rather unexpectedly gave U.S. banks the thumbs up to offer crypto custody services to their customers.

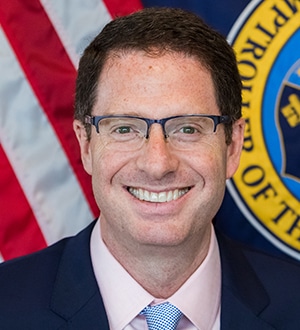

An interpretive letter published on June 22 by the Acting Comptroller Brian Brooks aims to clarify the U.S. federal regulator’s existing stance and authorize national banks and federal savings associations’s provision of cryptocurrency custodial services for their customers.

While the OCC’s new stance flew under the mainstream radar amidst the current turmoil in the U.S. caused by the Covid-19 pandemic and widespread civil protests, its significance has been lauded by key industry players.

Institutional investors, banks and crypto industry leaders alike consider it to be one of the biggest regulatory milestones for the mainstream adoption of crypto assets in years.

What is the Office of the Comptroller (OCC)?

The Office of the Comptroller is an independent U.S. Treasury branch established in 1863. The OCC, as it is known, supervises and regulates all national banks, federal savings associations, federal branches and foreign bank agencies.

The OCC and the Treasury’s Financial Crimes Enforcement Network (FinCEN) are both federal agencies mandated by the Banking Secrecy Act (BSA), who collaborate from time to time and occasionally release bulletins and advisories to help ensure consistency in the application of the BSA/AML requirements.

Where the OCC regulates U.S. banks, FinCEN investigates and prosecutes U.S.-related financial crimes such as money laundering.

OCC’s crypto custody letter clarifies existing policy for banks

On July 22nd 2020, the OCC published on its website an 11-page interpretive letter it had sent to an unknown bank.

The letter was authored by the current Acting Comptroller Mr. Brian Brooks, a former Coinbase executive who raised the hopes of the crypto community of having another powerful pro-crypto regulator with his appointment earlier in 2020.

Another high-profile crypto-friendly regulator is SEC Commissioner Hester Peirce, who is known for her progressive views on virtual asset regulation that has subsequently earned her the nickname “Crypto Mom”.

Mr. Brooks has not disappointed as the Acting Comptroller and has already tabled multiple regulatory reforms that could be considered advantageous to digital asset companies in the U.S.

These include a national payments charter to help crypto startups offering payment services without the need to go through costly and bureaucratic money transmitter licensing (MTL) on a state-by-state basis.

A Coindesk article argues though that the OCC’s groundbreaking crypto custody letter cannot solely be attributed to Mr. Brooks’ efforts and has indeed been years in the making.

In fact, the OCC had been studying the crypto space since at least 2018, and possibly longer, according to Jonathan Gould, senior deputy comptroller.

5 Key Points from OCC’s Crypto Custody Clarification

The OCC’s custody letter clarifies its view on why and how banks should conduct crypto custody in several paragraphs:

1. Crypto custody is a modern iteration of banks’ long history of safekeeping assets

“[…] “National and state banks and thrifts have long provided safekeeping and custody services, including both physical objects and electronic assets…

“[…] Providing custody services for cryptocurrency falls within these longstanding authorities to engage in safekeeping and custody activities…

“[…] The OCC concludes…. that providing cryptocurrency custody services, including holding the unique cryptographic keys associated with cryptocurrency, is a modern form of these traditional bank activities.”

2. Crypto custody services may extend beyond passively holding cryptographic keys

“[…] The OCC has found that the authority to provide safekeeping services extends to digital activities and, specifically, that national banks may escrow encryption keys used in connection with digital certificates because a key escrow service is a functional equivalent to physical safekeeping.”

3. Cold wallet technology is essential for banks’ digital asset safekeeping

“[…] Providing custody for cryptocurrencies would differ in several respects from other custody activities. Cryptocurrencies are generally held in “wallets,” …Hot wallets are …more susceptible to hacking. Cold wallets are …considered the most secure method of storing cryptographic keys.

4. The times they are a-changing and banks should as well

The OCC also emphasized that due to the increasing digitization of financial markets, banks will increasingly need to get on top of new technology. Banks will have to creatively incorporate it to serve their customers’ needs so that they can continue in their historical role as financial intermediaries.

“[…] As the financial markets become increasingly technological, there will likely be an increasing need for banks and other service providers to leverage new technology and innovative ways to provide traditional services on behalf of customers.”

“[…]By providing such services, banks can continue to fulfill the financial intermediation function they have historically played in providing payment, loan and deposit services.”

5. Banks have a duty to secure Americans’ assets in “safety deposit boxes or virtual vaults”

In an accompanying news release, the OCC notes that Mr. Brooks further stressed the need to ensure that banks can meet their customers’ needs, whether it be safety deposit boxes or virtual vaults.

“[…] Safekeeping services are among the most fundamental and basic services provided by banks…these services are the electronic expression of traditional safekeeping services provided by banks.”

The opinion therefore clarifies that banks can safeguard their customers’ most valuable assets, which now includes cryptocurrencies for “tens of millions” of Americans.

Who does the OCC’s crypto custody decision apply to?

“Federally Chartered Banks and Thrifts May Provide Custody Services For Crypto Assets.” The above-titled OCC news release declares that the Acting Comptroller’s opinion will be applicable to national banks and federal savings associations of all sizes.

It also gives federal approval to the efforts of states that have already given their state banks the go-ahead to proceed with crypto-offering services, and opens the doors for more “exotic services”. This could potentially include virtual asset staking and lending, which has helped skyrocket the nascent DeFI industry in 2020.

How the OCC’s custody letter benefits the crypto industry

The OCC’s pro-crypto clarification will be beneficial not only for crypto exchanges, but also the customers they service for a number of reasons. As BitWise’s Matt Hougan says in this Forbes article, it’s “a really big deal”. Hougan goes on to list a few benefits, to which we’ve added a few as well.

1. Leading the Way for More Regulatory Approval

The United States is notorious for the convoluted web it spins between state and federal regulations and lack of clarity in regards to crypto assets. While registering with FinCEN as a money service business (MSB) is straightforward, each state has its own complicated money transmitter licensing requirements, which can vary greatly in terms of cost and paperwork.

For example, in Hawaii MSBs only need a minimum net worth and surety bond of $1,000, while a Michigan license application requires a net worth of over $100,000 and a $500,000 surety bond.

While FinCEN, the CFTC and the SEC have began to take more decisive actions since 2019 to create clearer guidance and rules for crypto assets, such as FinCEN’s CVC Guidance of 2019, there has not been much genuine goodwill dispensed towards the crypto industry.

The OCC’s statement seems to have broken the deadlock and shows the regulator is ready to lead by example. By acknowledging the rapid growth and increasing importance of cryptocurrencies, the hardships that crypto businesses have had to overcome to receive banking services, the OCC has shown a firm grasp of the industry’s pain points and inner workings, and cleared the way for other regulators to follow suit.

2. Bringing crypto to the mainstream investor

By allowing banks to offer virtual assets to their customers, the OCC has essentially given the all clear for both institutional and retail investors to diversify their portfolio and acquire crypto assets.

These investors have been hesitant and sceptical of cryptocurrencies and the custodial institutions that offer it and have also been discouraged by the daunting technical knowledge it requires to own cryptocurrencies like Bitcoin and protect it against hackers and scammers.

The OCC’s letter now allows banks to develop user-friendly solutions for the purchase and selling of crypto assets that will appeal to a much wider audience who knows little about Bitcoin and is only concerned about its growing potential as a long term investment.

3. Better competition means a stronger industry

The short history of crypto like Bitcoin is riddled with a long list of crypto exchanges, initial coin offerings (ICOs) and other custodians who have lost billions of investors’ through incompetence, security hacks or exit scams.

While regulators like the FATF are now forcing virtual asset service providers (VASPs) to create stronger AML regimes such as enhanced customer due diligence and reciprocal information sharing (see the FATF Travel Rule), there is still much work to do.

Having banks now potentially enter the crypto custody market is ironic, as Bitcoin was originally designed in 2009 as an antidote to banks’ irresponsible business practices, which came to a head during the 2008 banking crisis.

However, with the crypto market starting to mature, banks will bring with them much-needed traditional finance best practice which will create new industry standards for the secure storage and transacting of digital assets. In order to attract the new mainstream investor, existing crypto custodians will have to get their house in order in terms of security, terms and customer support.

4. Crypto custodians can now be restructured as banks

Due to the regulatory uncertainty until now, crypto custodians have mostly structured their businesses as trust companies that act as fiduciaries or agencies on behalf of their clients.

Thanks to the new OCC stance, these trust companies can now restructure themselves as banks, which will give them advantages over other crypto firms, such as direct access to USD payment systems.

5. Crypto companies can turn to big banks for help

The struggles that crypto firms from the U.S. to Korea have had in being granted banking privileges due to the AML risks they pose, has been well-documented in the media, such as the Tether debacle. In the U.S. there have been only a handful banks like Silvergate willing to (very selectively) deal with crypto firms. This has slowed the growth of crypto firms and forced exchanges to shadier offshore banks and payment processors, or tax haven jurisdictions with friendlier banking institutions.

The OCC letter explicitly states that national banks can give crypto firms traditional banking services, thereby better protection against AML/CFT risks and exposure to possible fraud.

The $64k Bitcoin question: Will U.S. Banks Now Offer Crypto Custody Services?

Since the creation of Bitcoin in 2009, U.S. banks have grappled with the legal ramifications of offering cryptocurrencies, which has long suffered from a perception that it is a conduit for criminal activity, to their customers.

Regulators like FinCEN, the CFTC, SEC and OCC have been hesitant to issue clear guidance on what’s permissible and what’s not, partly due to the rapidly evolving nature of crypto which could cause them to paint themselves in a corner while they’re trying to understand blockchain technology and mitigate its risks.

As a result, most established banks across the U.S. simply chose not to offer crypto services to their customers, watching closely as crypto exchanges and custodians reaped the increasing rewards of managing users’ crypto assets.

However, the question arises now: Now that they’ve cleared to provide these crypto custodial services, will big banks now take the plunge to offer virtual assets to their clients and claim their share of crypto’s $300 billion market cap? The answer is yes, and no(t yet).

Yes- ANPR feedback showed pro-crypto sentiments

For the Yes camp, it certainly seems to be the case if one looks at banks’ reaction to the OCC’s “Advance Notice of Proposed Rulemaking” (ANPR) in June, in which the regulator asked the general public to comment before 3 August 2020 on how the financial sector could make use of cryptocurrencies. The overall consensus was that big banks would be open to supporting crypto asset services if the OCC could issue more regulatory guidance on the matter.

The public’s feedback yielded 89 submissions, including several by banks such as the U.S. Bank and PNC, and demonstrated significant interest from the financial sector to provide crypto custodial services.

A U.S Bank National Association spokesman asked for “additional regulatory clarity to service the cryptocurrency market as it is currently structure or may be structured in the future”, specifically in relation to custody service criteria, as well as an OCC differentiation between utility tokens, stablecoins and exchange tokens and cross-border limitations.

Banks’ increasing warming to crypto has been epitomized by the u-turn JP Morgan Chase has made in recent years. After CEO Jamie Dimon provoked industry ridicule for deriding Bitcoin as a “fraud that authorities would crush” only two years ago, the banking giant has since extended banking services to leading exchanges Gemini and Coinbase and also issued its own blockchain-based system JPM Coin.

No (t yet)

However, it is not that simple. Many industry insiders feel that banks won’t rush to throw their doors open to crypto investors, but will bide their time. Banks will still need to manage their risk properly and ensure they have legal protection in place first. The OCC encourages more engagement with the banking industry though in order to iterate on current regulations and make them more cohesive over time.

Offering cryptocurrency services unfortunately comes with several caveats. Both FinCEN and global regulators like the Financial Action Task Force (FATF) issued stringent new regulations in 2019 to help improve their anti-money laundering (AML) and counter-terrorism funding (CFT) regimes, most notably the FATF “Travel Rule” that requires exchanges to share transmittal data with each other when transacting.

U.S. banks are already subject to the complex Bank Secrecy Act (BSA) which in fact provided the origins of the FATF Travel Rule. Offering cryptocurrencies may potentially open them up to further risk, due to the shady and largely dark history that follows assets like Bitcoin along its blockchain and is gradually being uncovered by innovative AML analytics experts like Elliptic,who recently helped the FBI track and apprehend the TwitterHack culprits.

Due to the frequency of associated risks like crypto exchange hacks, exit scams and other shady behavior, banks will also be hesitant to extend services to virtual asset servicer providers (VASPs) who can prove anything other than a blemish-free track record.

Conclusion- What’s next for U.S. banks and crypto?

It’s important to keep in mind that banks move at an exponentially slower pace than the cryptocurrency industry due to excessive red tape, bureaucracy and regulatory obligations.

There is also the minor risk that the OCC’s latest reforms may be undone under a new administration if Joe Biden wins the election.

Therefore, banks will most likely gradually dip their toes in the crypto pool. According to Alex Batlin, CEO of digital asset custody provider Trustology, banks may take the “sub-custody” path by teaming up with or buying existing crypto custodians as a means of derisking.

However, it seems certain at present that big banks are coming, and with them, a mainstream market for cryptocurrencies. As the crypto industry continues to mature and a new class of millennial investors familiar with blockchain and with a generational preference for crypto assets over staid financial products becomes their main target market, banks will eventually have their Damascus moment – become increasingly obsolete or join the party.

When this expansion of banks’ services to include crypto custody becomes the norm,, the unlikely mass adoption of virtual assets will suddenly become as sure a thing as (digital) money in the bank.

Written by Werner Vermaak

About CoolBitX and Sygna Bridge

CoolBitX’s Sygna Bridge is a first-to-market travel rule solution and alliance network that is live and being used by our VASP partners to share compliant originator and beneficiary transmittal information.

Sygna Bridge completed a successful production test report (Big 4 audited) earlier this year, which was presented to the FATF Contact Group in May 2020. Sygna Bridge now also supports the IVMS101 messaging standard.

CoolBitX has signed MoUs with 18 VASPs worldwide and recently joined forces with Elliptic in a combined quest to help crypto companies comply with the FATF Standards.

For enquiries on the FATF Travel Rule and our Sygna Bridge solution for VASPs, please contact us at info@sygna.io.